Algorithmic trading, often seen by energy traders as a concept of the future, is making its mark in this market more rapidly than anticipated. It is highly likely that you have someone at your trading desk who is currently quite skeptical about the application and merits of algorithmic trading. In this blog, we delve into the evolution of algo trading and its impact on energy trading in the UK right now.

The Rise of Batteries and their Impact on Trading

The increasing prominence of algo trading in energy markets stems from the need to tame the market alongside the need to make a profit. This need is largely driven by the evolution of the UK market, particularly with the introduction of batteries.

Initially, batteries were introduced to cater to the need for inertia-based energy reduction and renewable power strategies. However, as more batteries enter the market with divergent strategies, predicting fair market price becomes increasingly challenging.

The surge of micro-generation and solar panel usage in homes altering peak usage patterns, and the advent of electric vehicles capable of feeding energy back to the grid have all contributed to market price volatility (even your toaster is an energy price speculator!). As a result, each trader faces an almost infinite set of prices to trade at, depending on their portfolio demands. This has created the demand for algo bots to help to understand the sheer complexity of these supply and demand forces.

The Advent of Automation in Energy Trading

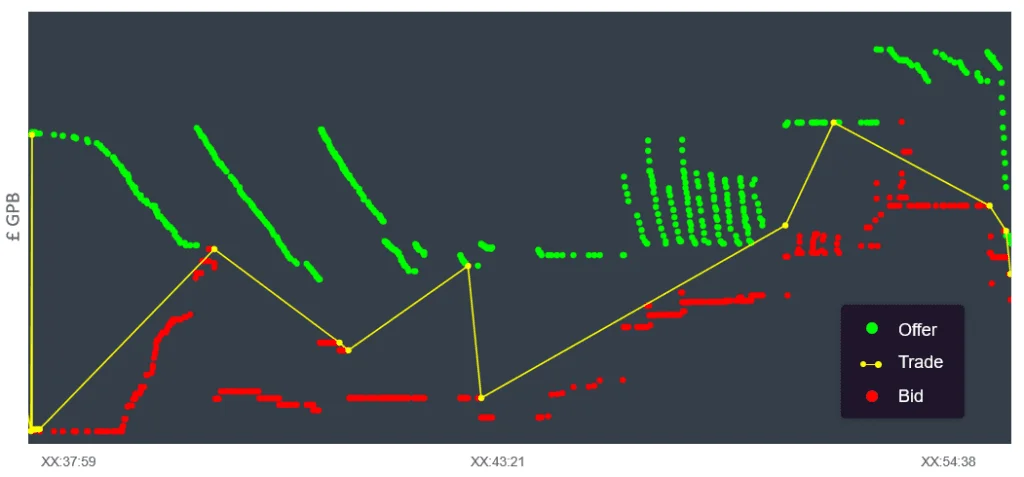

Managing the trade of 7 to 8 products simultaneously is becoming increasingly challenging. As a result, automation is on the rise, with players seeking to automate bids and offers to close their positions.

This can be seen in the visual below:

As discussed in our previous blog on this topic, The new era of algorithmic energy trading in Great Britain, this new age of optimising profit or minimising loss is increasingly becoming a speed endeavour, alongside fundamental trading.

These algorithms, more commonly referred to as “bots”, when they are in production, are poised to take the centre stage. Our current research shows an increasing number of such bots taking over traditional manual trading. As a result, Brady is also embracing the bot driven world of trading.

Brady’s Approach to Algo Trading

At Brady, we have developed a proven toolkit for creating trading algorithms. Traders from our customer organisations are applying a scientific approach to demonstrate that they can use our toolkit to make a reasonable profit. We don’t just focus on the profitability aspect, but also on risk management. Variance, outliers, and starting position assumptions all form part of a back-testing framework before any algorithms are introduced to the markets.

We are working to ensure the algorithms can be neatly and easily packaged into production “bots” that are ready to prove their worth in the market – that do not ‘misbehave.

With compliance high on corporate agendas, we are committed to delivering transparency and readability of the bots that our customers can create using Brady developed AI tools.

The Future of Algo Trading in the GB Energy

As we look to the future, we anticipate a market flooded with bots, each striving to trade as effectively as possible. Different times of the day respond differently to algo strategies, with volatility being a key driver. We see many market participants working their orders hard in periods of low volatility. This raises an intriguing question: does the presence of algorithms cause more volatility, or does it reduce it? At Brady, we are in search of the answer to this new energy paradigm.

While the benefits of algo trading are clear, it’s important to also consider potential challenges. These could include regulatory hurdles, the need for robust cybersecurity measures, and the potential for market manipulation. As we continue to explore the world of algo trading, we remain committed to addressing these challenges and unlocking the full potential of this technology.

In conclusion, the future of algo trading in the UK energy markets is promising. As we continue to navigate this complex landscape, we invite you to join us on this exciting journey.

The Author

Navesh Kumar

Lead Data Scientist