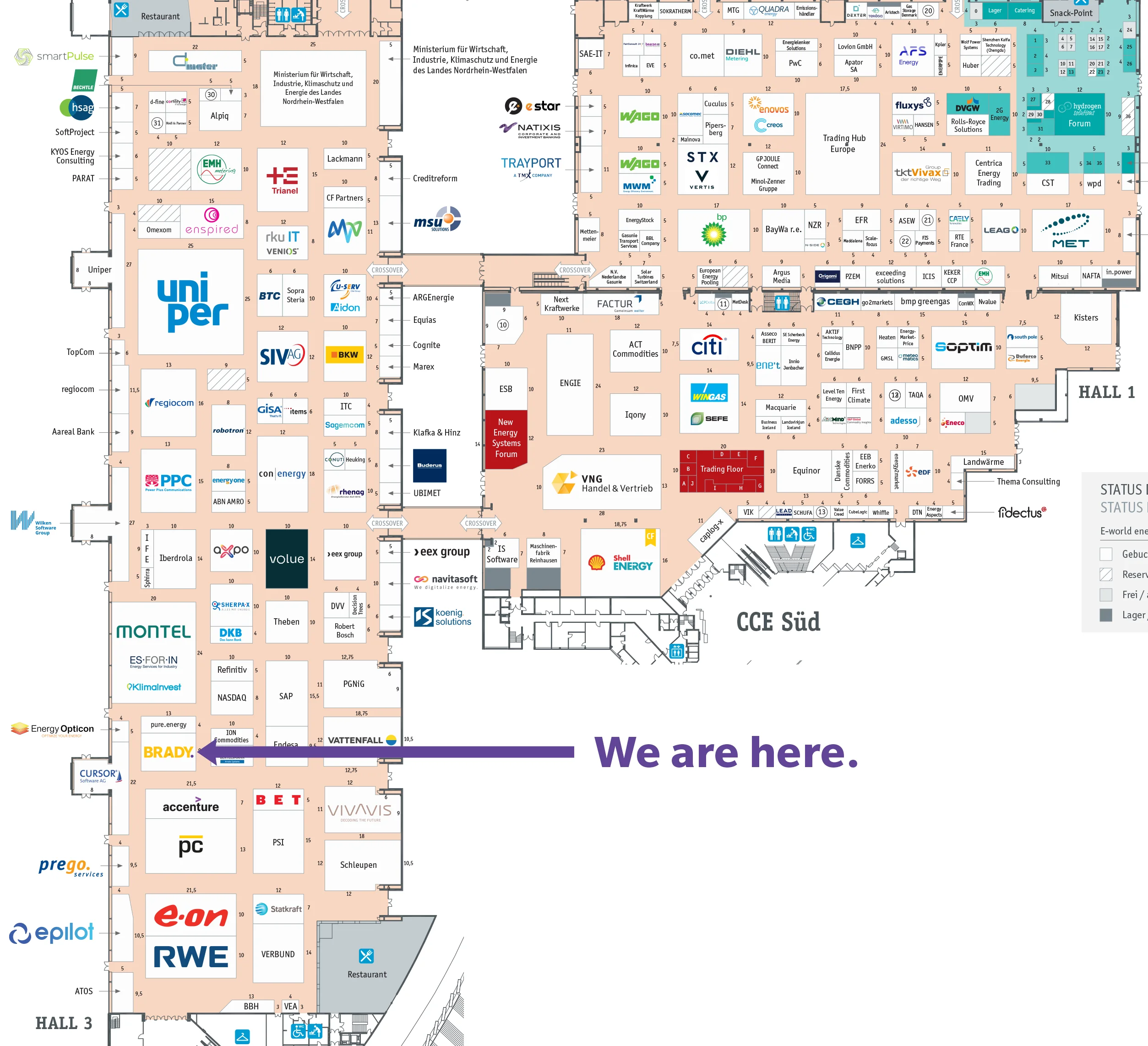

Brady Technologies at

E-world 2023

Dates: 23-25 May 2023

Venue: Messe Essen

City: Essen, Germany

Location: Halle 3, Stand 110

Book a meeting with Brady

Join us at Europe’s largest annual energy industry gathering.

We can't wait to see you there!

Showcasing the Brady solution suite

(click to select)

-

Short-Term Power

PowerDesk -

Power Scheduling

PowerDesk Scheduler -

ETRM (SaaS)

Igloo -

ETRM (On-premise)

Brady ETRM -

Nordic Power

EDM -

Credit Risk

CRisk

An advanced SaaS Dashboard for intraday and day-ahead power trading

Discover PowerDesk, our award-winning and patented SaaS trader dashboard, specifically designed to provide a central hub for intraday and day-ahead power trading. Schedule assets, optimise operations, execute trades, and fulfil delivery obligations from one place. Gain unique insights and trade intermittency with unparalleled visualisation capabilities.

Deliver power across most of Europe in one place

Discover PowerDesk Scheduler, a single solution for delivering power through the majority of TSOs across Europe. Covering 25+ countries and major interconnectors, save time and adhere to TSO deadlines by performing scheduling and checking balances close to real-time.

A high-performance SaaS ETRM solution for curve trading

Discover Igloo, a SaaS ETRM solution developed in collaboration with one of the world’s largest financial energy traders. Experience state-of-the-art user interfaces, unrivalled exchange connectivity, and support for automated trading volumes exceeding 10,000 trades per day.

European enterprise-wide ETRM solution

Discover Brady ETRM. Built for asset heavy trading entities with complex risk modelling needs, Brady ETRM acts as the central trading operations hub for major regional European utilities.

Robust physical power trading operations

Discover Energy Data Manager, a market-leading trading and communication platform for Nordic power trading. Manage day-ahead, intraday, and reserve market bidding, including FCR, aFRR, and mFRR in one place. EDM supports high-volume time series data management for trading, production, and metering data.

Manage all credit processes intuitively in one place.

Manage the entire the OTC counterparty lifecycle from assessment to limit allocation and exposure management with ease, both current and PFE. CSA collateral management and liquidity forecasting also supported.

Expert Forum

Happy Flexibility: How Decentralised Storage Supports Grid Stability

We are delighted to announce Brady's Chris Regan will be speaking on the E-world conference programme!

Date: Tuesday 23rd May

Time: 15:00 GMT+1

Location: Future Forum, Hall 4

Meet the team face-to-face

Talk to our experts on how to set up a curve trading desk, fast optimise your credit risk process build an algorithmic ecosystem set up a short term power desk