Environmental, Social and Governance ‘ESG’, continues to be high on the agenda of corporate strategies, operations, and positioning in many parts of the world and across many industry segments. ESG as an audit item is an important criterion for many investors and financing organisations. With respect to energy and broader commodities, it is emerging rapidly as an important facet of the industry. ESG can include a lot of different requirements with the potential for greater definition, thus policies need to be somewhat flexible and adaptable.

Like many other firms, at Brady Technologies (Brady), we have a published an internal strategy to ensure that our daily activities meet ESG values and are fair to our customers, staff, and partners. Furthermore, we are aligning our product roadmaps to address the evolving ESG needs of our customers trading in short-term power markets specifically.

What is ESG within the Energy System?

A definition of ESG by Investopedia says that “ESG criteria are a set of standards for a company’s behavior used by socially conscious investors to screen potential investments. Environmental criteria consider how a company safeguards the environment, including corporate policies addressing climate change, for example. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.”

In the energy industry, ESG strategies are often assessed by the organisation’s level of sustainability, social responsibility and how well these match the customers’ values.

ESG in the context of short-term power trading

Short-term power trading is changing rapidly and is a major focus for our business. Software products that specialise in this area can help market participants to pursue their ESG agendas. In this article, we map out our main short-term power market products to the Energy ESG values, which are defined as follows:

- Decarbonisation and carbon footprint transparency

- Decentralisation

- Competition

- Market stability

- Market compliance

Brady software products considered in this article are PowerDesk for intraday and day-ahead power trading, Energy Data Manager (EDM) for time-series data analysis, EDIS for pan European cross border scheduling and EDIL for Irish power system balancing. Collectively, these products allow market participants to:

- Rebalance their positions to aid a system operator in safely and securely rebalancing the electricity system,

- Run their generating assets as efficiently as possible, increasing market efficiency and bringing low prices to the end consumer,

- Offer their services into a competitive market, ensuring customers are not exposed to “abusive squeezes” or other forms of poor behaviour under the Market Abuse Directive,

- Allow for the build out of more intermittent renewable generation – either allowing our customers to trade wind/solar directly but also allowing providers of flexibility to complement renewables by stabilising

We will now look at these areas in more detail.

Decarbonisation

All Brady short-term power software must support a future where energy supplied is from a decarbonised source. Decarbonised energy has certain attributes including the fact that is it:

- Intermittent: you can’t plan,

- Non-synchronous: fails to provide services to the system operator,

- Traded in the short-term,

- Often underwritten by Power Purchase agreements that must be risk managed.

Short-term power market software must also support the trading and dispatch of these and other assets, and help users to manage these challenges to allow decarbonisation of the energy system.

Additionally, the software must, where necessary, provide sufficient timely and accurate information regarding carbon footprints so that this can be measured, offset, and reported.

Decentralisation

Historically, national energy systems have been mostly operated by inefficient and monolithic centralised operators. The lack of competition with monopolies, oligopolies and regulated pricing does not best allow for fair and effective price discovery.

Brady’s energy trading products must:

- Allow new energy companies to enter the markets and challenge incumbents,

- Be priced and designed to work at scale or with smaller start-ups,

- Support micro assets and smart grids as well as traditional power stations.

Competition and ensuring a fair market price to customers

Historically, when power markets have not had transparent price discovery, effective traders who were looking to optimise their plant, or their schedule prices have been able to move significantly away from fair value. In addition, liquidity has been insufficient and the plant that could have protected prices was not scheduled. Such inefficient markets are not good for consumers, and may lead to “missing money” and windfall profits to incumbents.

To ensure the end consumer is getting fair value Brady’s energy trading products must:

- Not be designed to allow one company to dominate price,

- Ensure that our customers run their assets optimally increasing overall energy system efficiency,

- Manage liquidity to allow others to also gain fair market price.

Market stability

Energy in the home or the business is more than just a commodity – it’s a key part of modern society. The effective generation, transmission, and stability of energy is a life sustaining requirement across each country.

As the grid decarbonises it also tends to destabilise as well. To counteract this effect our software must:

- Facilitate countries to work together for a stable interconnected system,

- Ensure services such as frequency and voltage support are efficiently offered to the system operators,

- Ensure generation is dispatched as expected to allow for easy system balancing.

Market abuse, avoidance and compliance

Energy trading, generation dispatch and energy supply are regulated activities that require participants to comply with legislation such as REMIT (The Regulation on Wholesale Energy Market Integrity and Transparency) or MAD (Market Abuse Directive). Brady products will need to help customers remain compliant by ensuring:

- They have full transparency of their activity

- Market rules are embedded into our products

- Our products are made available to all

- We work with system operators and regulators can input into our products.

Summary

Brady committed to its own ESG policies and as a part of that, we have developed ESG strategies and policies for our energy software and services that are applicable to this industry. This article summarised these policies as they stand currently and will be updated as ESG regulations and policies continue to be defined by regulatory bodies and the industry itself. Customers can be assured that we are helping to ensure that their ESG strategies are supported adequately by our software and services.

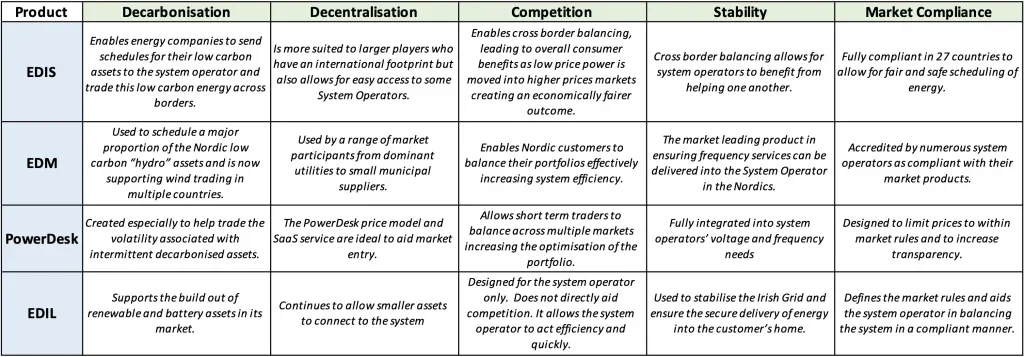

Brady’s energy trading software suite – compliance matrix

Brady’s Compliance Matrix

Written by

Chris Regan

Business Lead, Short-term Power Trading

As an energy trader, Chris was present at two market openings before heading up EDF Energy’s Trading and Operations capabilities between 2009 and 2017. As Vice Chair of the Power Trading Committee and Chair of Energy UK’s Wholesale Markets subcommittee, Chris helped create the current Energy market we have today, making changes to the energy trading products, negotiating the mandatory market making rules and making changes to allow customer’s assets to be re-optimised closer to real-time.

In 2017 Chris delivered a distributed trading capability (Powershift) into EDF, allowing customers to access markets alongside EDF’s own fleet of power stations and batteries. EDF’s Powershift is now a leading player in the UK flexibility market, optimising batteries, engines and DSR on behalf of EDF’s customers and is part of the international group’s flexibility offerings.

Chris has a background in Physics and complements this with an MBA from INSEAD.

About Brady Technologies

Brady Technologies (‘Brady’) provides trading, risk management and logistics software solutions to energy markets. We help energy trading participants to profit in new ways from the green transition and support ESG requirements.

Our heritage in European energy spans over 30 years. Our customers comprise some of the most renowned energy organisations in Europe, engaged in financial and physical trading on major exchanges including Nord Pool, EPEX, CME, Nasdaq and ICE, as well as OTC.

Brady solutions cater for utilities, independent power producers, asset developers, asset optimisers, energy traders, oil & gas companies, commercial aggregators and hedge funds, helping to optimise trading performance, drive greater visibility and cost control across the trade life cycle.